Tracking the Trends: Historical Insights from Six Senior Hospital Indemnity Carriers

Let us dive right into the historical performance of six key players in the senior Hospital Indemnity market, examining how their earned premiums and loss ratios have trended over time.

Spoiler alert: the trend is a positive one!

If you are new to the Hospital Indemnity space, learn more by downloading our FREE Product Essentials Guide. Also, for additional data on market size and projected growth, browse to our store for the Market Projection Report.

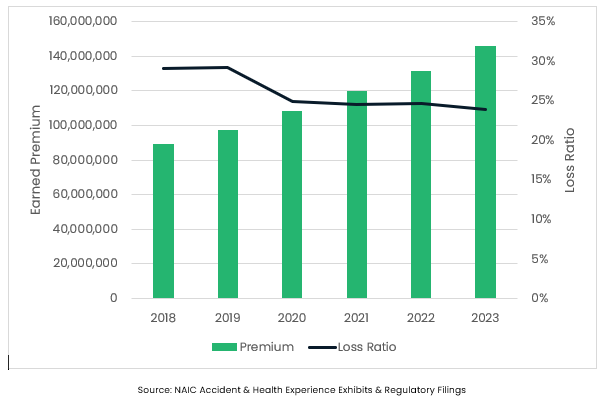

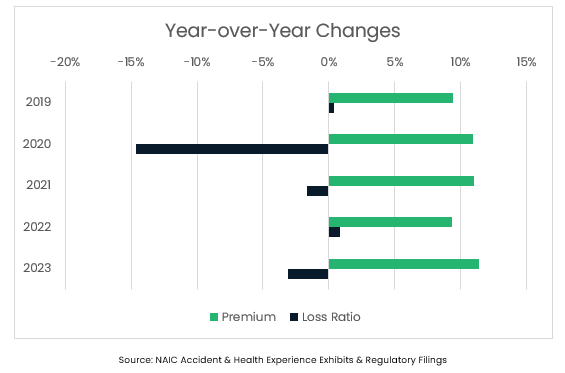

The table below shows aggregated experience for these carriers from 2018 through 2023. The key takeaway: rising premiums paired with consistent loss ratios. Notably, loss ratio experience exhibited a decline in 2020, likely attributable to the effects of COVID-19, and have remained at those lower levels in the years since.

Over the past several years, these six companies’ senior Hospital Indemnity plans have shown a promising shift in performance. Since 2019, earned premium has increased roughly 10% each year. Outside of the drop in 2020, loss ratios have remained fairly consistent during that same period.

As these carriers have experienced loss ratios below expected levels, states that require annual rate certification filings – such as Colorado, Florida, and North Carolina - have required rate decreases and/or benefit increases on these products. Recent regulatory filings indicate that several of these carriers have implemented rate decreases ranging from 15.0% to 50.0% in those states.

The sustained loss ratio experience in this space is certainly notable and appears to be gaining some attention – regulatory filings also show additional carriers are adding their senior-focused hospital indemnity products to the mix. With steady business volume increases from these established carriers, it appears that the space may get more crowded, and growth may accelerate. We will be watching!