GoHealth Inc.’s 4th Quarter 2021 LTV/CAC

Telos Actuarial recently compiled key information on GoHealth Inc.’s (NASDAQ: GOCO) 4th Quarter Financial results.

One of the key metrics reported by GoHealth on a quarterly basis is LTV/CAC. LTV/CAC is the lifetime value (“LTV”) of commission revenue over the customer acquisition cost (“CAC”).

LTV/CAC is a common financial measure for SaaS and eCommerce companies.

A bigger number is better as LTV/CAC is indicating how much value is being created by the enterprise. A ratio less than 1.0 indicates the company is destroying value, while a number greater than 1.0 indicates the company may be creating value. 3.0 and greater is often considered good.

GoHealth’s LTV/CAC ratio decreased 50% during 2021 (1.4 in 2021 compared to 2.8 in 2020).

So, what caused the decrease?

In short, both LTV and CAC went the wrong direction…

1 Decreasing LTV (Lifetime Value)

As previously reported, GoHealth’s LTV decreased during 2021 (Medicare Advantage went from $900 for 2020 to $842 for 2021).

The decreasing LTV is largely driven by lower customer retention.2 Increasing CAC (Customer Acquisition Cost)

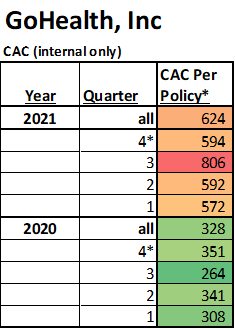

CAC increased from $328 to $624 per approved policy (internal sales only).

*Estimated based on reported info.

A large part of the increase in CAC is due to a decrease in enterprise revenue. The reason this is important is because enterprise revenue is used to offset customer acquisition costs.

On a per approved policy basis (internal sales only) the enterprise revenue dropped from $416 in 2020 to $195 in 2021.

Excluding the enterprise revenue offset, the estimated “true” customer acquisition costs increased from $744 to $819 per approved policy (internal sales only) in 2021.

You combine those together, and you get a suffering LTV/CAC:

*Estimated based on reported info.

GoHealth LTV and CAC definitions

LTV = Lifetime Value

For GoHealth it’s the expected amount of commissions they will receive over the life of each approved policy

CAC = Customer Acquisition Cost

For GoHealth this is cost of revenue, marketing and advertising, customer care and enrollment, less enterprise revenue per approved policy

Note: GoHealth reports LTV/CAC for internal commissionable sales only

Source data: GoHealth Inc.’s quarterly Form 10-Q & Form 10-K (https://investors.gohealth.com/financial-information/quarterly-results)

Telos Actuarial helps distributors maximize the lifetime value (“LTV”) of their commissions by providing persistency analysis, industry lapse and persistency reports, projected commission cash flow analysis, and LTV calculations. Send us an email for more information. info@telosactuarial.com