eHealth Inc.’s 4th Quarter 2021 – MA approved policies and LTV both up 3% year-over-year

Telos Actuarial recently compiled key information on eHealth Inc.’s (NASDAQ: EHTH) 4th Quarter Financial results.

One of the key metrics reported by eHealth on a quarterly basis is constrained Lifetime Value (“LTV”) per approved policy. LTV is the estimated amount of commissions the company expects to receive over the life of the policy, per approved policy.

eHealth’s LTV decreased for Medicare Supplement “MS” and Prescription Drug Plans “PDP” when compared to the same quarter last year. However, LTV for Medicare Advantage “MA” increased by 7% compared to the same quarter last year.

eHealth’s full year LTV increased for all product lines except Medicare Supplement and PDP. Medicare advantage LTV increased 3% year-over-year.

eHealth attributes the Medicare Advantage LTV increase to higher commission rates while the decrease for Medicare Supplement and PDP is due to shorter estimated plan durations (“persistency”).

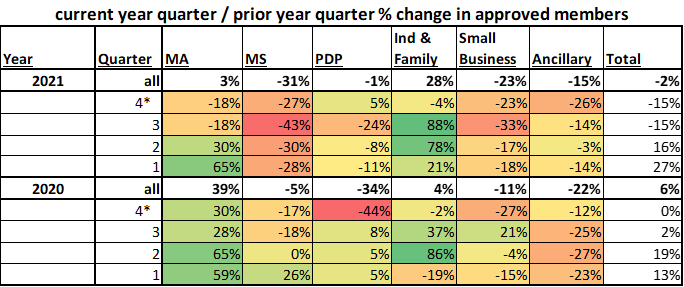

Another key metric reported by eHealth is approved policy counts. Overall approved policy counts decreased 15% when compared to the same quarter last year, and decreased 2% year-over-year.

The decrease in approved policy counts for the year was largely driven by Medicare Supplement and Ancillary. Both Medicare Advantage and Individual & Family saw growth in approved policy counts year-over-year.

eHealth mentions the following in relation to lower Q3 & Q4 Medicare Advantage results. “…investment in our telesales operations, technology and enrollment quality assurance have negatively impacted our second half results, we believe that they will create long-term competitive advantages for us as carriers place an increasing value on enrollment quality and reduction in beneficiary complaints.”

*Estimated based on year-end results **Unable to estimate due to changes in reporting of Approved Policies

Source data: eHealth Inc.’s quarterly Form 10-Q & 10-K (https://ir.ehealthinsurance.com/financial-information/sec-filings)

Telos Actuarial helps distributors maximize the lifetime value (“LTV”) of their commissions by providing persistency analysis, industry lapse and persistency reports, projected commission cash flow analysis, and LTV calculations. Send us an email for more information. info@telosactuarial.com