Medicare Supplement Rate Actions - 2026 Q1 Update

The Medicare supplement market continues to experience higher claims and carriers are attempting to mitigate the higher loss ratios by pursuing larger rate increases. Early 2026 average rate increases have continued to trend up from 2024 and 2025. Now, results through the end of January are in.

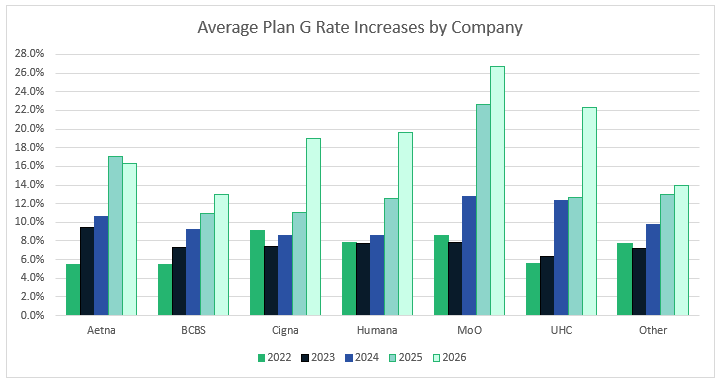

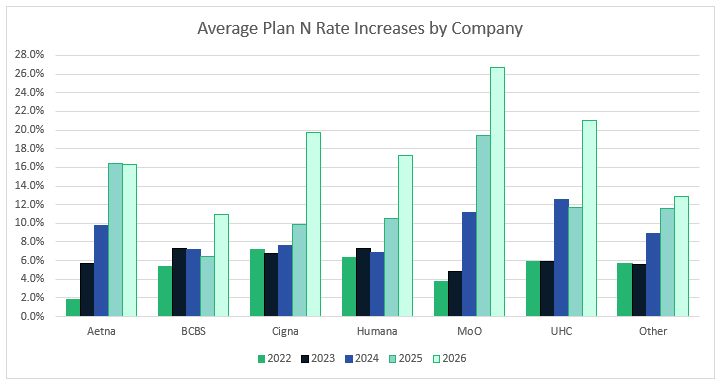

The charts below summarize the average historical rate increases of the most prominent carriers in the Medicare supplement space. This data pertains only to open blocks of business and does not consider instances where companies are implementing large rate decreases as they re-enter the market using old paper. All carriers besides the largest six have been grouped together as “Other”.

Let’s start with Plan G.

All groups, besides Aetna, show a larger rate increase amount in 2026 than in previous years. The data shows that Aetna and Mutual of Omaha were ahead of the market with a large jump in increase amounts from 2024 to 2025. Cigna, Humana, and United Healthcare had a smaller jump in 2025, but early data shows a 7 to 10% jump from 2025 to 2026.

Next up is Plan N.

Again, all groups, besides Aetna, display larger increases in 2026 than 2025. You can see that some companies show a more gradual reaction to increasing claims trend while some have acted more swiftly.

For all plans, we expect the trend of higher rate actions to continue into 2026 as carriers continue to pursue improved loss ratios. Companies that acted quickly would have seen a deterioration in their competitive positioning but should see more rapid improvements in their loss ratios.

Our team has extensive experience filing rate increases. We can help guide you through the development of your rating plan and help you get the most difficult filings approved.